2024 Disability Pay Chart Irs

2024 Disability Pay Chart Irs. Tax season in 2024 starts on january 29 and if you had income in 2023 you likely need to file a federal tax return by tax day on april 15, 2024. It depends on the specific benefits program you're eligible for.

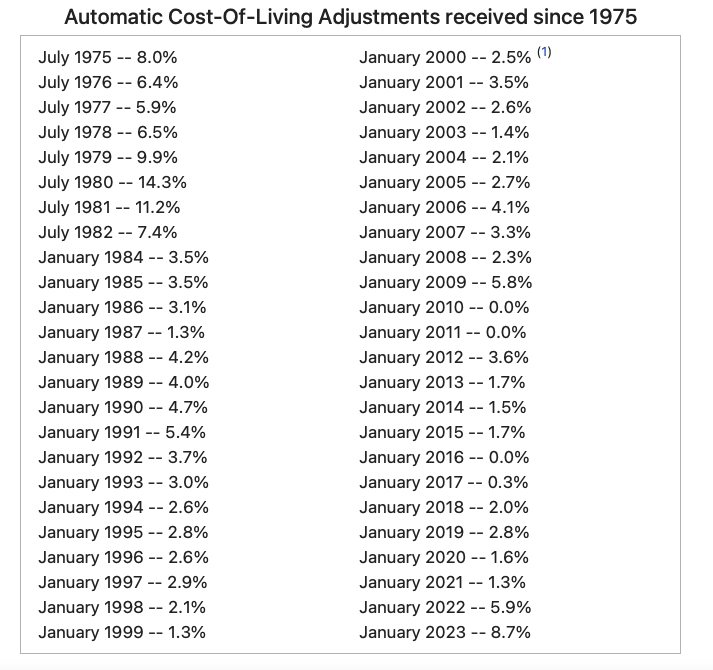

Don’t include disability benefits you receive from the department of veterans affairs (va) in your gross income. On the basic monthly rates table, find the amount for your disability rating and dependent status.

2024 Disability Pay Chart Irs Images References :

Source: vitoriawleda.pages.dev

Source: vitoriawleda.pages.dev

Veterans Benefits Pay Chart 2024 Sadie Collette, The ssa updates this pay.

Source: brandeqkrissie.pages.dev

Source: brandeqkrissie.pages.dev

30 Va Disability 2024 Josey Mallory, The latest increase of 3.2% becomes effective january 2024.

Source: ilyssaqcissiee.pages.dev

Source: ilyssaqcissiee.pages.dev

2024 Disability Limits Niki Teddie, Get insights into payment amounts and eligibility criteria.

Source: betsyrenata.pages.dev

Source: betsyrenata.pages.dev

Va Benefits 2024 Pay Chart Lara Saloma, Va will count your disability compensation from this date to the day they begin to pay you.

Source: www.oilandgasawards.com

Source: www.oilandgasawards.com

Social Security Disability Pay Chart 2024 All You Need to Know, In the case of disability pay, whether it is taxed or not usually depends on who paid for the disability insurance coverage.

Source: www.rtuexam.net

Source: www.rtuexam.net

Social Security Disability Benefits Pay Chart 2024 Check SSDI Benefit, And you’ll receive that money in a lump sum.

Source: doriableilah.pages.dev

Source: doriableilah.pages.dev

2024 Disability Pay Chart Vatican Brenn Libbie, Your birth date usually determines your social security disability.

Source: brettykirbee.pages.dev

Source: brettykirbee.pages.dev

Va Disability Increase 2024 Chart Nanci Valeria, It depends on the specific benefits program you're eligible for.

Source: opheliawjohna.pages.dev

Source: opheliawjohna.pages.dev

Ca Disability Tax Rate 2024 Manon Rubetta, Irs provides tax inflation adjustments for tax year 2024.

Source: maudiewdasi.pages.dev

Source: maudiewdasi.pages.dev

Social Security Disability Pay Calendar 2024 blair coralie, On the basic monthly rates table, find the amount for your disability rating and dependent status.

Posted in 2024