Lifetime Gift Tax Exclusion 2024 India

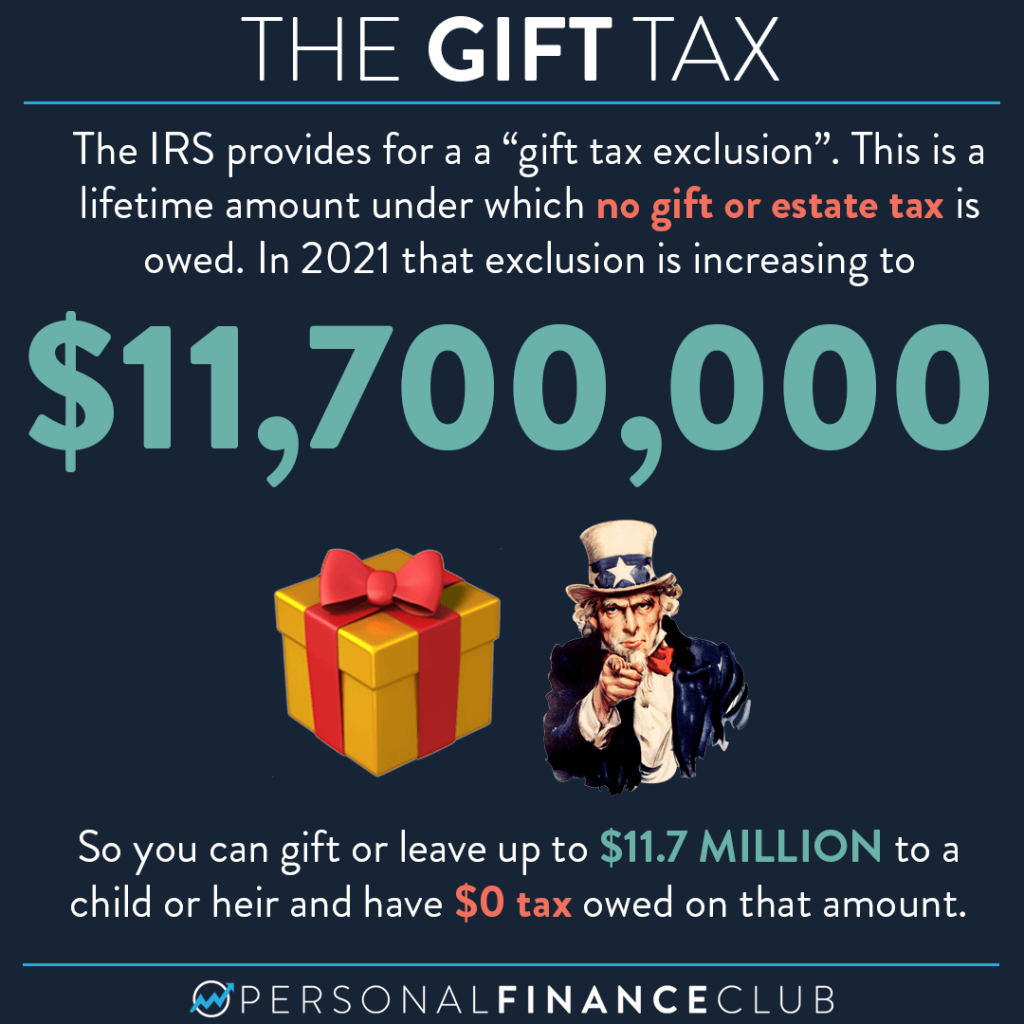

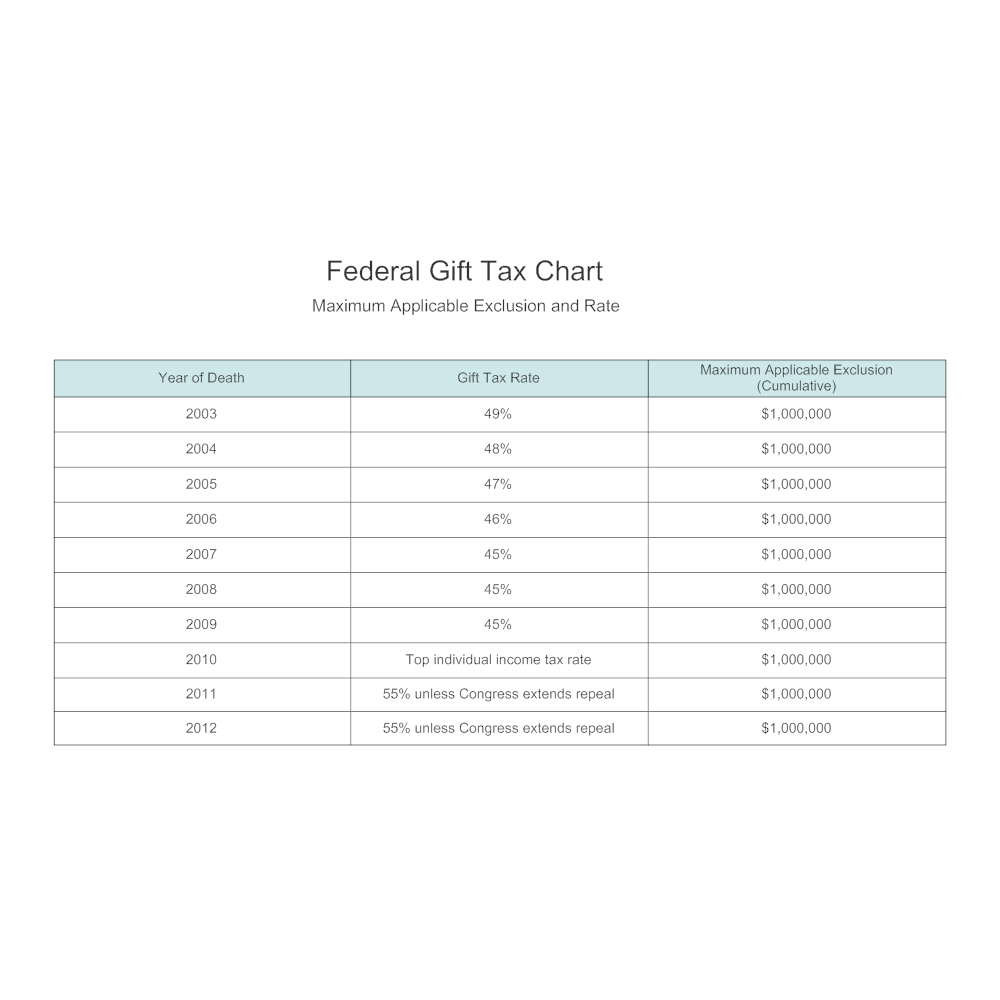

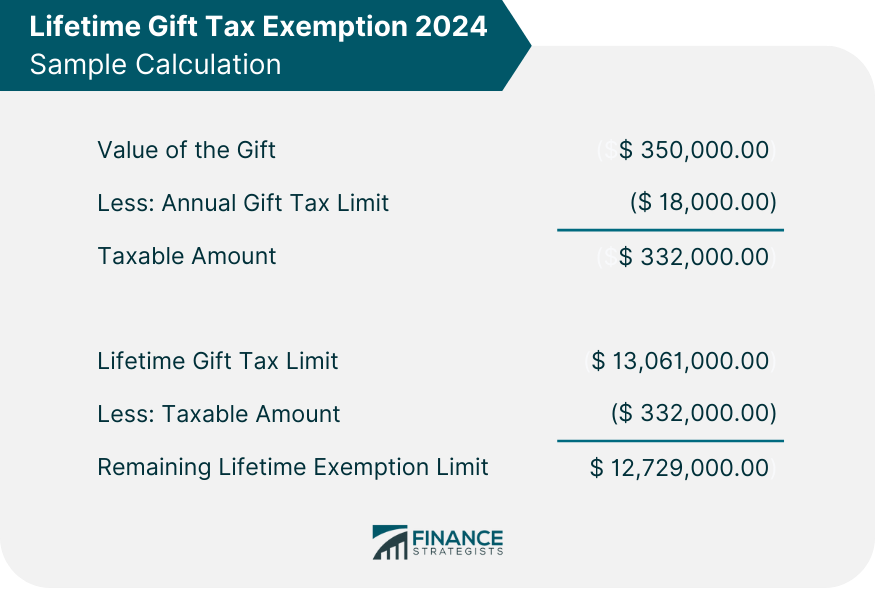

Lifetime Gift Tax Exclusion 2024 India. There's no limit on the number of individual gifts that can be made, and couples can give. The tax cuts and jobs act delivered a sizable increase in the tax exemption limit for estates and lifetime gifts — up to $13.61 million per person in 2024.

Married couples can transfer $27,220,000 during their lives. This exemption is combined with the estate tax exemption to cover both the total value of.

Lifetime Gift Tax Exclusion 2024 India Images References :

Source: thedayshirline.pages.dev

Source: thedayshirline.pages.dev

Lifetime Gift Tax Exclusion 2024 Form Denise Tarrah, You report excess amounts beyond the annual exclusion on form 709, but actual gift tax payment only occurs if the total surpasses the lifetime limit.

Source: meggibmadonna.pages.dev

Source: meggibmadonna.pages.dev

Lifetime Gift Tax Exclusion 2024 In India Lucy Merrie, Married couples can transfer $27,220,000 during their lives.

Source: nikkiyrevkah.pages.dev

Source: nikkiyrevkah.pages.dev

Gift Tax 2024 Exclusions In India Hester Devondra, In 2024, individuals can transfer $13,610,000 free of estate, gift and gst tax during their lives or at death;

Source: twylaygiorgia.pages.dev

Source: twylaygiorgia.pages.dev

Lifetime Gift Tax Exclusion 2024 In India Angel Blondie, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024, estimated to be $19,000 in 2025).

Source: meggibmadonna.pages.dev

Source: meggibmadonna.pages.dev

Lifetime Gift Tax Exclusion 2024 In India Lucy Merrie, For 2024, you can give up to $18,000 to each recipient without triggering the gift tax, which is known as the annual gift tax exemption.

Source: brigityvilhelmina.pages.dev

Source: brigityvilhelmina.pages.dev

Gift Tax 2024 Exclusion In India Randi Carolynn, In 2024, individuals can transfer $13,610,000 free of estate, gift and gst tax during their lives or at death;

Source: brigityvilhelmina.pages.dev

Source: brigityvilhelmina.pages.dev

Gift Tax 2024 Exclusion In India Randi Carolynn, Understanding how it works and its pros and cons can help you make smart.

Source: marciycorenda.pages.dev

Source: marciycorenda.pages.dev

Gift Tax 2024 Exclusions In India Amalea, The federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person and $27.22 million per married couple next year.

Source: pierydorthea.pages.dev

Source: pierydorthea.pages.dev

Gift Tax 2024 Exemption In India Fiona Jessica, If your filing is more than.

Source: thedayshirline.pages.dev

Source: thedayshirline.pages.dev

Lifetime Gift Tax Exclusion 2024 Form Denise Tarrah, Likewise, at death, any taxable bequest beyond.

Category: 2024